|

|

|

|

Engagement

By Dean Lambert, Executive Director, LIC

As I wait for my connecting flight home to Des Moines in the central plaza of the Charlotte airport, listening to the din of travelers and a pianist playing a current pop song I cannot place, I am reflecting on the LIC Human Resources Committee meeting we just concluded. Hosted at the lovely headquarters of AFBA/5Star Life in Alexandria, VA, right outside our nation's capital, we were a small but mighty gathering of HR leaders in person and virtually. We addressed all the world's problems....

|

Industry News

|

Women's Market Holds Key to Life Insurance Industry Growth

In recognition of Women's History Month, LIMRA published "Three Reasons Why the Women's Market Holds the Key to Life Insurance Industry Growth" as encouragement for the industry to continue helping more women build a financially secure future.

|

U.S. Life Insurance Premium Sets New Record in 2023

For the third consecutive year, total U.S. life insurance new annualized premium set a new sales record. In 2023, new annualized premium increased 1% to $15.7 billion, according to LIMRA's U.S. Life Insurance Sales Survey, which represents 85% of the market. LIMRA projects sales growth will continue in 2024 and 2025.

|

March 20 Webinar Offers Practical Advice for PAS Modernization

Equisoft is presenting a webinar March 20, 2024 at 12 p.m. ET on "PAS Modernization from Project Veterans." In this session, industry leaders will discuss the right ways to select vendors and solutions, obtain buy-in, plan, and execute modernization projects that will drive sustainable ROI.

|

Young Appointed CEO of LCBA as Tuttle Retires

Doug Tuttle, a Past Chair of LIC, has announced his retirement from LCBA Life after 33 years of dedicated service, with the last 15 as President and CEO. Brian Young was appointed the new President and CEO of LCBA, effective January 1, 2024.

|

LIC Final Expense Workshop Heads to St. Louis

The 2024 LIC Final Expense Workshop will be hosted by RGA in St. Louis June 5-6, 2024. Registration and hotel information can be found on the meeting website linked below.

|

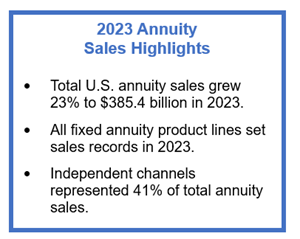

Record-High 2023 Annuity Sales Driven by Growth in Independent Distribution

Propelled by $286.6 billion in fixed annuity sales, total U.S. annuity sales reached a record-high $385.4 billion in 2023, jumping 23% year over year, according to final results from LIMRA's U.S. Individual Annuity Sales Survey.

|

Homesteaders to Reorganize as Mutual Holding Company

Homesteaders Life Company's policy owners voted in February 2024 to restructure into a mutual holding company, following the Board of Director's unanimous vote to approve the restructuring late last year.

|

This Annuity May Compete for Mutual Fund Market Share

Chris Blunt, CEO of F&G Annuities and Life, which launched its first RILA product in February 2024, discussed potential for registered index-linked annuities to compete with mutual funds, a $1 trillion marketplace, in a securities analyst call reported by ThinkAdvisor.

|

California Adopts Best-Interest Legislation

In February 2024 California Gov. Gavin Newsom signed state Senate Bill 263, making it the 44th state to adopt the NAIC annuity sales model update, as reported in Investment News.

|

Reinsurance Sidecars Attract Growing Interest

Milliman's Prannoy Chaudhury wrote about the increasing use in the life and annuity industry of "sidecar" reinsurance vehicles, which provide a structure for insurers to access third-party capital.

|

Register for the 2024 Life Insurance & Annuity Conference, April 15-17, 2024: Life and Annuity Conference (limra.com)

|

Upcoming LIC Events

LIC Operations & Project Management Committee Webinar:

Brand Promise + Strategy Execution = Positive Outcomes

Presented by Heaton Consulting

April 24, 2024, 2-3 pm ET (Moved from March 13)

www.loma.org/LICStrategyExecutionWebinar

|

Video: Leveraging Annuity Growth

Chris Conklin of Miller & Newberg describes the LIC Annuity Committee presentation he'll be participating in, along with Parkway Advisors, Allen Bailey & Assoc., and LIMRA.

|

LIC Annuity Committee Meeting

Hosted by Equisoft, Montreal

March 26-27, 2024

www.loma.org/LICANNUITY

LIC Technology Committee Conference Call

April 18, 2024, 2-3:30 pm ET

www.loma.org/LICTECHCC

LIC ERM Committee Meeting

Hosted by Liberty Bankers Insurance Group, Dallas

May 7-8, 2024

www.loma.org/LICERM

LIC Laws & Legislation Committee Conference Call

May 10, 2024, 2-3:30 pm ET

www.loma.org/LICLL

LIC Financial & Tax Accounting Committee Virtual Meeting

May 23, 2024, 2-4 pm ET

Request Notification

LIC Final Expense Workshop

Hosted by RGA, St. Louis

June 5-6, 2024

www.loma.org/finalexpense

Insurance companies and fraternals are eligible for discounted bundle pricing: www.loma.org/LICSAVE

|

LIC 2024 Premier Sponsors

Thank you to these LIC Premier Sponsors, who support all LIC events throughout the year.

Parkway Advisors

Parkway Advisors is focused on being the best most respected provider of service in the insurance industry. Parkway offers asset management, consulting, and statutory investment reporting services that are customizes to the needs of each insurance client. Through Parkway's emphasis on personal service, custom solutions, and strong communication, our clients have enjoyed historically strong performance success, especially during the financial crisis and the low interest environment that has followed. www.parkwayadvisors.com

iPipeline

iPipeline is a leading provider of low code, cloud-based software solutions for the life insurance and financial services industry. Through our SSG Digital, end-to-end platform, we provide process automation and seamless integration between every participant in our ecosystem including carriers, agents, general agencies, advisors, broker-dealers, RIAs, banks, securities/mutual fund firms, and their consumers on a global basis. Our innovative solutions include pre-sales support, new business and underwriting, policy administration, point-of-sale execution of applications, post-sale support, data analysis, reporting, user-driven configuration, consumer delivery and self-service, and agency and firm management. www.ipipeline.com

thinktum/illustrate

thinktum and illustrate inc (merged in 2023) provide powerful, cloud-based end-to-end solutions for life insurance carriers to energize, automate, simplify, and streamline the application process for virtually any life insurance product or distribution channel.

The no-code/low-code LIZ and OPUS platforms combine to provide a comprehensive, adaptable, and client-focused solution for life insurance carriers, with a particular emphasis on the needs of small to medium-sized carriers. The goal is to provide not just a technological solution but a partnership that understands the unique challenges and ambitions of each client. www.thinktum.com

QLAdmin Solutions

QLAdmin Solutions is a leading technology partner for the small to mid-sized insurance company offering traditional life, health, annuity, preneed, final expense, and Medicare Supplement products. QLAdmin serves the entire policy lifecycle from new issue to termination with expert policy administration processing that is both comprehensive and easy to use. QLAdmin continues to evolve based on product and client needs ensuring extreme client longevity and satisfaction with QLAdmin products and support. QLAdmin is your proven partner in policy administration. www.qladmin.com

Equisoft

Equisoft is a business-first technology company dedicated to helping insurance and wealth management organizations reach their goals. Specialized expertise: Over 25 years of experience helping small and mid-sized life insurers & fraternals solve their biggest challenges through digital transformation. www.equisoft.com

|

About The LIC Bullet

The Bullet is the official e-newsletter of the Life Insurers Council, which has been providing networking and practical business solutions for life insurers since 1910. As a council of LOMA, LIC serves the unique needs of small-to-midsize member companies, offering a personal network of peers with practical solutions to shared challenges. The Bullet delivers immediate and relevant industry news and editorial.

LIC E-News Online Community: As a networking organization, we welcome dialogue and input from our readers – therefore we are transitioning the Bullet to its new home in the LIC E-News online community at LICConnect. All Bullet subscribers have access to this forum, and others can request access by contacting lic@loma.org.

|

Feature Article (Full Text)

Engagement

By Dean Lambert, Executive Director, LIC

As I wait for my connecting flight home to Des Moines in the central plaza of the Charlotte airport, listening to the din of travelers and a pianist playing a current pop song I cannot place, I am reflecting on the LIC Human Resources Committee meeting we just concluded. Hosted at the lovely headquarters of AFBA/5Star Life in Alexandria, VA, right outside our nation's capital, we were a small but mighty gathering of HR leaders in person and virtually. We addressed all the world's problems.

Well, maybe not the world's problems per se, but we did touch on nearly every major challenge and opportunity in the Human Resources world!

[By the way, I just met my first drug-sniffing German Shorthair Pointer ever. Why he drew his handler to my carry-on is a mystery, and why he's not in a field hunting birds is even more curious. But I digress….]

According to our guest presenter, Jack Walsh, managing director of insurance search firm The Jacobson Group, 33% of employees are engaged in their work and workplace. There are many flavors of engagement, ranging from participating in team meetings and company events to showing up at the office at all. Let's agree on a definition of the word "engagement." Since you're not here in Charlotte to edit, let's say it's "to occupy the attention or effort of a person or persons."

We can easily agree that the pandemic sparked many challenges beyond those that previously existed to gain the attention and manage the efforts of employees even when they were all in the building together. Many of us experienced challenges of creating enthusiasm and energy, particularly for those departments where team members typically have more heads-down functions. These "quiet corners" include essential functions requiring focused scrutiny of things like code, columns, and contracts. While these experts may collaborate easily with one another, their work is typically project-focused with little eye on why the project is important to the organization and its customers. In my experience, there's a great deal of missed opportunity when people are not frequently reminded in appropriate and relevant ways of the company's "WHY." Some of the best ideas can emerge from the quiet corners of an enterprise, believe me. You just need to draw them out.

Today, some employees may be much more in their comfort zone in the new hybrid world, regardless of if they are required to be in the office or can work from home. Whether they work in a headquarters devoid of office chatter and management-by-walking-around, or in their home office setup, they're safe from someone in Sales or Marketing popping by with a well-intentioned fist-bump or thoughts on how we might improve the company's agent enrollment app.

For most of the HR leaders participating in our meeting over the past two days, there was a nostalgic sense when talking about how important it is to have some kind of regular presence in the office. Some of their companies require employees to come in one day per week or month. Others require three-plus days in-office for senior leadership and two or more days for managers or department heads. Some require office days to be the same each week. These policies are welcomed by some employees; others may be inspired to look for a different situation.

As leaders we should remember that, for many of our valued team members, it may be a huge challenge to make coming into the office part of their daily or weekly lives, pivoting from the previous major life adjustment of finding appropriate workspace in their homes, dealing with noisy pets and similar interruptions, arranging (and paying for) faster and more secure internet service, and so on. Now, three years after establishing and getting accustomed to this new routine, we're once again changing their lives. It's a lot, even for leaders who have been required to do many of the same things while also learning an entirely new way to manage and motivate, to grow productivity through very challenging times.

This group resolved, as many companies would, that hybrid work is here to stay. The rules of engagement are changed forever. Yet engage we must, not unlike the need to engage distributors, policy owners and even your community.

It is at this juncture I begin to get drawn into the inevitable tie I see between everything a company does, and why it exists, with BRAND. I can't help it, after many years as a marketing officer, but I do feel you'll thank me for it, because the strategies and tactics marketers use to attract, engage, and retain customers and distributors are the very same we should use for employees.

Not everyone gets romantic about their experience with a brand, but everyone tends to turn to brands that consistently align with their needs, values, and how they feel when they engage (shop and buy). I am not suggesting more work for your marketing team (I don't want to lose my union card…).

However, I may suggest that you consider the disciplines and tactics used to attract and engage customers. Let's examine a few:

Incentives

- What does your company offer as an enticement to attract and hold the attention of prospects, how might this translate to your employees?

- What does your company offer to distributors and policy owners to create a sense of loyalty? How might you transpose this to employee loyalty?

- Does your company provide incentives for distributors, partners or policy owners to recommend you to others? If you don't already offer spot bonuses for recommended candidates and hires, you might consider it.

Purpose

- Research shows that among other employee and job-seeker considerations such as compensation, benefits and flexibility, having a sense of purpose and contributing to a common good is important. For most life insurance companies and fraternal associations, this is a slam-dunk; but can you articulate yours in a concise, inspiring manner?

- How do you communicate and edify how each individual contributes to their team's and the company's mission and vision-the value offered to stakeholders and communities?

- Do you offer time off for employees to contribute time to causes important to them? Do you offer matching financial gifts to qualified charities?

- The analog for this is what companies like Subaru are trying to accomplish when they contribute a percentage of revenue to causes their customers believe are relevant.

Aspirations and Futures (thank you, Jacobson)

- Make sure your employees and job seekers understand their futures with the company.

- Be open to cross-functional moves when it aligns with career aspirations and organizational needs.

- Recognize some employees may be happy in their roles or desire lateral opportunities.

- Provide and communicate-often-resources to help eliminate stress and foster a sense of community.

Education

- A key strategy in marketing today is consumer education. I used to think communicating the value of prearranged funerals was a challenge, but there really is only one question to answer for most: "How do I get started?" The life insurance marketplace is not only crowded, but product nuances and considerations make it complicated, too. Just like consumers, your employees need (and want) education. It helps them understand and hopefully enjoy their job more, and you will gain greater value in terms of ideas and creativity when they learn.

- Education helps people achieve the top two stages in Maslow's hierarchy of needs: Esteem (respect, self confidence, recognition, strength and freedom); and Self-Actualization (a desire to become the most that one can be). It's easy to connect these to a brand and a product, but the challenge is communicating this to prospective buyers because of all the "noise."

- The key with job seekers and employees is to focus less on the table stakes (comp and benefits) and more on connecting your company's "WHY" to how it helps all stakeholders obtain and retain their most important needs.

We had a fantastic LIC networking and learning experience this week. Every LIC meeting and event is designed for maximum value delivered for your convenience and a great experience. I hope to see you at one of the in-person or virtual events remaining this year!

|

|

|

|

|

|

|